Energy

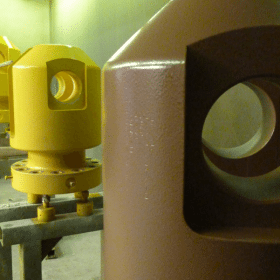

Renown group have a long standing history of supplying into the energy sector. High integrity topside and subsea components are our core capability.

We supply engineering services such as fabrication, welding, machining, painting and coating to major sector operators, including pipeline and SURF (subsea, umbilicals, risers and flowlines).

Oil & Gas

Renown Engineering is fully capable of meeting the demanding needs of our Oil and Gas customers through our expertise, location, quality and flexibility.

Our experience includes:

- Clamps

- Collars

- Pump casings

- Pull heads

- Anchor bases

- Tether clamps

- Bend restrictors

- Roving heads

- NORSOK specified coating and painting

Based in the North East of England, we are ideally located to service the UK Oil and Gas industry. Our stringent quality management system conforms to the requirements of BS EN ISO 9001 and is accredited by Lloyd’s register of quality assurance.

The Oil and Gas industry relies upon quick turnaround and on-time delivery. Our business structure as a flexible SME enables a rapid response to customers with demanding, time bound requirements.

Renown Group Oil and Gas

As part of the Renown Group, Renown Engineering’s sister companies, Renown Oil & Gas and PJ Engineering Products also operate in oil and gas, providing extensive engineering services, expertise and capacity.

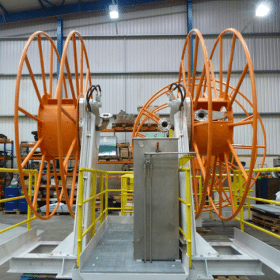

Marine

Renown Engineering has supplied the marine industry for over 25 years. Our experience includes:

- Guide funnels

- Cable Reels

- Cable Chutes

- Davits

- Stanchions

- UTA, PLEM, PIHO, Mudmat, Repair joint, Test heads, High pressure end fittings, Reel packing.

Westmoor Engineering

To compliment our Marine services, Westmoor Engineering, a trading name of Renown, supplies door and hatch products components for diverse applications, from vessels to offshore structures, including FPSOs and wind turbines.

Turnkey packages can be provided which includes design, manufacture, installation, commissioning, servicing, full control systems and bespoke pallets & tooling.